Cash In on Rentals: What’s a Good ROI on Vacation Rental Property

Investing in a vacation rental property can provide excellent returns compared to other asset classes like stocks or bonds. However, not all vacation rentals make good investments. You need to carefully analyze key metrics and factors to identify properties with the highest return potential.

This comprehensive guide will walk through everything you need to know to calculate return on investment (ROI) for vacation rentals, find profitable properties, maximize income, and operate a successful rental business.

Calculating Return on Investment Metrics

There are several key metrics investors should analyze to determine the profitability of a vacation rental investment.

Capitalization Rate

The capitalization rate (cap rate) compares your rental's net operating income to the current total property value.

The formula is: Cap Rate = Net Operating Income / Property Value

Net operating income equals all revenue from rents minus all operating expenses, including mortgage payments, taxes, insurance, maintenance, management fees, utilities, etc.

Average cap rates for vacation rental properties often range from 4-8% in many markets. The higher the cap rate, the better the investment potential. A property with a cap rate of 6% or more can represent a solid investment in many areas.

Cash-on-Cash Return

The cash-on-cash (CoC) return measures the annual cash flow you receive compared to the total cash invested in the property upfront.

It is calculated as: CoC Return = (Annual Cash Flow / Total Cash Invested) x 100

For example, if you have $60,000 in net annual cash flow and invested $300,000 total to purchase and renovate the property, your cash-on-cash return would be 20%.

Cash-on-cash return is a clear indicator of how much tangible income the property generates annually versus your capital invested. Look for CoC returns of at least 10-15% to beat average stock market returns. The higher the cash-on-cash return, the better.

Difference Between Capitalization Rate and Cash-on-Cash Return

At first glance, both the capitalization rate and cash-on-cash return might seem to measure the profitability of an investment property. However, they assess different aspects of the investment and are derived from distinct sets of data.

Basis of Calculation:

- Capitalization Rate (Cap Rate): It evaluates the profitability of a property based on its total value. It's a metric that gives a snapshot of the property's potential returns, independent of the financing structure. In essence, it’s like looking at the return you’d get if you paid for the property entirely in cash.

- Cash-on-Cash Return (CoC): This metric is concerned with the actual cash investment made by an investor. It calculates the return based on the out-of-pocket cash you put into the property, taking into account financing and mortgage details. It’s especially useful for investors who finance their properties, as it shows the return on their direct cash investment.

Data Inputs:

- Cap Rate: Uses Net Operating Income (revenue minus all operating expenses) and the full Property Value.

- CoC: Considers the Annual Cash Flow (after debt service or mortgage payments) and the Total Cash Invested (down payment, closing costs, renovation expenses, etc.).

What They Represent:

- Cap Rate: Provides a rate of return on an investment property based on its income-producing potential relative to its value. It helps investors compare different real estate investments and market conditions.

- CoC: Highlights the immediate return on the actual cash an investor has put into a deal. It's a crucial metric for those wanting to understand their liquidity situation or their annual return from the property in relation to their initial investment.

While both metrics are valuable in assessing the return on a real estate investment, the cap rate gives a broader picture of a property's income potential, and the CoC focuses on the immediate cash return relative to the investor's outlay. Depending on an investor's financial strategies and goals, one metric may be more relevant than the other, but using both together can provide a comprehensive understanding of an investment's potential.

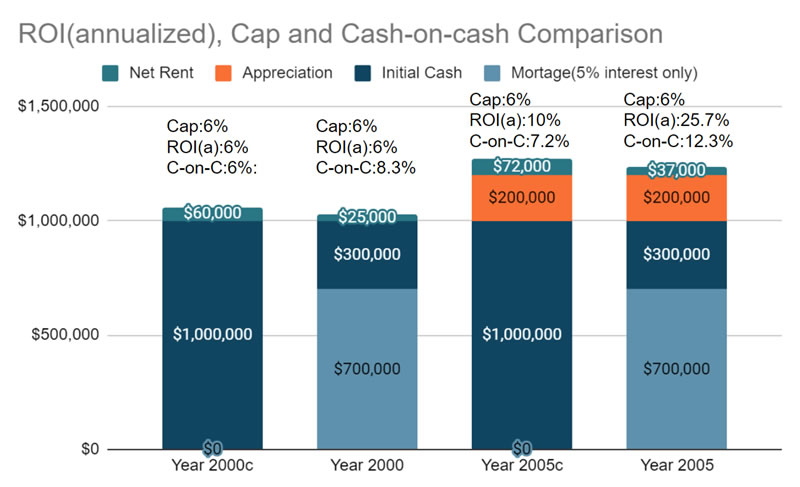

Here is an example

In Year 1, you acquired $1 million rental property. You collected $80,000 in rent, with a net income of $60,000 after covering all direct expenses.

The cap rate, cash-on-cash and ROI are all 6%.

If you get 70% mortgage at a 5% interest rate, the cash-on-cash return is calculated as follows:

((6% - 5%) x $700,000 + 6% x $300,000) / $300,000 = ($7,000 + $18,000) / $300,000 = 8.3%.

In year 5, where the market in your area still maintains a 6% cap rate, but your net rent has increased by 20% to $72,000. Additionally, your property's value has risen by 20% by appraisal, reaching $1.2 million.

The ROI has increased to 7.2%, calculated as: $72,000 / $1 million = 7.2%.

And the cash-on-cash return has also increased: ((7.2% - 5%) x $700,000 + 7.2% x $300,000) / $300,000 = ($15,400 + $21,600) / $300,000 = 12.3%."

Annualized Return on Investment

While cap rate examines ROI based on current income and value, annualized ROI factors in appreciation.

The formula is:

Annualized ROI = (Net Operating Income + Yearly Appreciation) / Total Property Value

As an example, if you purchase a vacation rental property for $500,000, have $30,000 in net operating income, and factor in 5% yearly appreciation, the annualized ROI would be:

($30,000 + $25,000 appreciation) / $500,000 = 11%

The higher the annualized ROI, the more profitable the investment. Look for vacation rentals with projected annualized returns of 15% or more.

Debt Paydown Return Another factor to consider is the forced equity you build as mortgage debt is paid down. This can add 1-3% annually to your overall ROI.

For example, if you put 20% down on a $500,000 property, the bank loans the remaining $400,000. With a 30-year fixed rate mortgage at 5%, your principal paydown would be around $7,400 in year one.

Add this to your net cash flow and appreciation to understand your total ROI.

Financing a Vacation Rental Property

There are several options for obtaining financing to purchase an investment vacation rental:

Conforming Loans

Conforming loans meet the standards to be purchased by Freddie Mac and Fannie Mae. This includes:

- 20% minimum down payment

- 620+ credit score

- Strict debt-to-income ratios

- Lower interest rates

Conforming loans work for vacation rentals if you meet the qualifications. But reduced cash flow from vacancies makes it harder to qualify for traditional financing.

Portfolio Loans

Portfolio lenders provide financing for real estate investors and are more flexible than conforming loans. Typical terms include:

- 15-20% minimum down payment

- No income verification

- Higher debt-to-income ratios allowed

- May require good credit score

Portfolio loans allow you to purchase multiple vacation rental properties. You may be able to tap home equity as a down payment source.

Bridge Loans

Bridge loans provide short-term financing if you need to close quickly before obtaining permanent financing. They usually have:

- 6 -12 month term

- 50%+ loan-to-value ratio

- Higher interest rates

- End-of-term balloon payment

Bridge loans can be used if you find a good vacation rental deal with a tight closing deadline. You can refinance into longer-term debt later.

Hard Money Loans

Hard money loans come from private lenders and have the fewest restrictions, but higher costs. Common terms are:

- No minimum credit score requirement

- 50-70% loan-to-value ratio

- Interest rates from 7-15%

- Points and fees 2-5% of loan amount

Hard money gives flexibility if you can't qualify for traditional financing but expect high returns. The right vacation rental could justify the costs.

Crowdfunded Loans

Real estate crowdfunding platforms provide an alternative financing option. Investors fund your loan request and earn interest while you retain ownership.

Benefits include:

- Typically requires 20%+ down payment

- Limited paperwork and quick funding

- Interest rates from 8-12%

Crowdfunded loans allow you to tap into investor money rather than relying solely on banks.

Using leverage improves ROI by increasing cash flow and debt paydown. But only take on what you can comfortably afford.

Finding the Best Vacation Rental Investments

The key to maximizing ROI is finding profitable vacation rental properties in top locations at good prices. Here are strategies to source great deals:

MLS Listings

Work with a real estate agent to setup alerts for new vacation rental and short term rental listings in your target locations. Study the listing details like historical performance.

Airbnb, Vrbo, Vacasa

Browse Airbnb, Vrbo, and Vacasa for available vacation rental properties listed by owners. You may uncover off-market properties before they are widely promoted.

Networking and Wholesaling

Attending real estate networking events and meetups can lead to hearing about deals from other investors before they hit the open market. You can also build a buyers list and have people bring you off-market deals in return for an assignment fee.

Roofstock and Evolve

Roofstock and Evolve allow you to instantly buy performing vacation rental properties. They vet listings, so less due diligence is required.

Auctions and Foreclosures

Check auction sites for vacation home foreclosures in your target area. You may get a great bargain on a property that just needs some renovations.

Direct Mail and Driving for Dollars

Target distressed homeowners or expired listings by sending direct mail offering to buy their property. Look for vacant homes as you drive potential neighborhoods.

Thoroughly vet any property for projected returns before purchasing. Avoid buying based on emotions rather than the numbers.

Maximizing Occupancy and Income

To generate strong returns, you need to keep occupancy high by attracting guests consistently throughout the year. Here are tips to maximize bookings:

Competitive Pricing

Set rental rates in line with comparable active rentals in the area. Check Airbnb's rate tool for pricing guidance. Don't overprice - some income is better than no income.

Seasonal Discounts

Run promotions, discounts, and offers during slower seasons or periods to incentivize bookings when demand is lower.

Listing Widely

List your rental across multiple sites - Airbnb, Vrbo, Booking.com, Vacasa, TripAdvisor, etc. The more sites, the more potential exposure.

Quality Photos

Invest in professional photography and videos to showcase your property. Great visual content will convert more lookers into bookers.

Dynamic Pricing

Use dynamic pricing tools like Beyond Pricing, Wheelhouse, PriceLabs, and Everbooked to automatically adjust your rates based on demand trends. This optimizes both occupancy and revenue.

Property Manager

Consider hiring a property manager, especially if you live far from the rental. Their expertise can help maximize occupancy and income. Aiming for 50%+ average annual occupancy will provide healthy cash flow. Monthly rental income should cover at least 50% of your mortgage payment as a baseline.

Tax Benefits of Owning Vacation Rentals

One of the best perks of investing in vacation rentals are the significant tax advantages owners can utilize:

- Depreciation Deductions - Depreciate the value over 27.5 years even as it appreciates. This creates paper losses without cash outlay.

- Expense Write-Offs - Deduct all expenses for managing and operating the rental against the income. Things like maintenance, utilities, supplies, and mortage interest.

- Travel Expenses - Write off costs for travel to visit and manage the property. Mileage, flights, hotels, meals/entertainment, and more.

- Tax Gain Exclusion - Pay no taxes on up to $250k/$500k capital gains as a single/married owner if used as a primary residence for 2 of last 5 years.

- 1031 Exchanges - Defer capital gains taxes when selling by doing a 1031 exchange into another investment property.

Be sure to consult a knowledgeable tax professional to maximize your deductions and minimize your tax liability.

Pros and Cons of Vacation Rentals

While vacation rentals can provide excellent returns, they have some unique advantages and drawbacks to consider: Pros of Vacation Rentals

Higher Income Potential - Nightly and weekly rentals bring in higher revenues than long term leases. Especially in peak seasons.

More Flexible Use - You can use a vacation rental for personal vacations in off-seasons when unbooked. Harder with long term tenants.

Greater Cash-on-Cash Returns - Typical CoC returns of 8-12% beat the 6-8% range for long term rentals in many markets.

Tax Benefits - Significant write-offs and deductions are available for expenses, mortgage interest, depreciation, and travel.

Appreciation - Well-located vacation rentals may appreciate faster than the market due to high demand.

Cons of Vacation Rentals

Seasonal Fluctuations - Income and occupancy fluctuates based on seasons and peak travel times. Budget carefully.

More Management - Turnover between guests creates more frequent cleaning/maintenance needs than long term tenants.

Restrictions - Some areas limit short term rentals through zoning laws, condo bylaws, or HOA rules. Research before buying.

Higher Expenses - Extra costs for insurance, utilities and furnishings since it's not owner-occupied year-round.

Financing Difficulty - Lenders may charge higher rates/fees than an owner-occupied purchase. Lower debt ratios.

Analyze local market conditions carefully to balance advantages and drawbacks before investing.

Operating a Profitable Vacation Rental Business

To generate strong returns, you need to operate your vacation rental like a business:

Furnishings

Fully furnish the property attractively to match your target demographic - families, couples, groups, etc. Provide all needed amenities - TVs, wifi, kitchenware, towels/linens, toys, cribs, etc.

Photography

Invest in professional photography and videography to showcase the property's best attributes and room layouts. Clean and stage the space for photos.

Listings and Distribution

Create listings on multiple booking sites - Airbnb, VRBO, Booking.com, Vacasa, etc. Drive bookings to your own website as well. Keep listings updated and descriptions enticing.

Dynamic Pricing

Use dynamic pricing tools to automatically adjust your rates based on demand, seasons, events, and more. This will maximize both occupancy and rental income.

Promotions

Offer promotions and discounts during slower periods to attract bookings. Free nights, discounts for longer stays, packages, and deals incentivize guests.

Guidebooks

Provide local guidebooks and personal recommendations for the best restaurants, activities, attractions, and conveniences nearby. This improves the guest experience.

Property Manager

Consider hiring a property manager, especially if not local, to handle cleaning, maintenance, restocking, guest communication, and other logistics.

Run your vacation rental like a data-driven, optimized business for the best returns on investment.

Conclusion

A profitable vacation rental with great returns requires careful analysis of key metrics like cash-on-cash, cap rate, and annualized ROI to identify sound investments. Thoroughly research locations, optimize occupancy and income, utilize tax benefits, and run as a business.

Vacation rentals can generate significant wealth through high cash flow, debt paydown, appreciation, and tax savings. But you need the right property and business systems to maximize your ROI. Use this guide to make informed investment decisions and operate a successful rental.

Introduction

A good return on investment (ROI) on a vacation rental property is a measure of the profitability of the property. It is calculated by dividing the net profit of the property by the initial investment made in the property. The net profit is the income generated from the property minus any operating expenses and taxes. A high ROI means that the property is generating a good profit, while a low ROI means that the property may not be as profitable.

Factors For ROI's

There are several factors that can affect the ROI of a vacation rental property, including location, demand, and operating expenses.

Location

The location of the property is important because it determines the demand for rental properties in the area. Properties in popular vacation destinations or locations with high foot traffic will typically have a higher demand and therefore a higher ROI.

Demand

Demand for vacation rentals can also be affected by the type of property and the amenities it offers. For example, a vacation rental with a pool or hot tub may have a higher demand than a property without these amenities. Additionally, properties that are well-maintained and offer a high level of comfort and convenience for guests may also have a higher demand and therefore a higher ROI.

Operating Expenses

Operating expenses, such as property taxes, insurance, utilities, and maintenance, can also impact the ROI of a vacation rental property. These expenses can vary greatly depending on the location and size of the property, as well as the amenities it offers. It is important to carefully consider these expenses when evaluating the potential ROI of a vacation rental property.

There are also various strategies that can be used to maximize the ROI of a vacation rental property. These strategies include pricing the property competitively, optimizing the listing on vacation rental websites, and offering incentives to guests, such as discounts for longer stays or free activities.

It is difficult to determine a specific ROI that is considered “good” for a vacation rental property, as it can vary greatly depending on the specific property and location. However, a ROI of at least 10% is generally considered a good starting point. This means that for every $100,000 invested in the property, the owner should expect to earn at least $10,000 in profit. Of course, the ultimate goal is to maximize the ROI as much as possible, and this can be achieved through careful planning and management of the property.

Conclusion

In conclusion, a good ROI on a vacation rental property is an indication of the profitability of the property. It is influenced by a variety of factors, including location, demand, and operating expenses. By carefully considering these factors and implementing strategies to maximize the ROI, owners of vacation rental properties can increase their profitability and achieve a good return on their investment.

Quick Links

Contact Us

- Phone number: (425)578-9494

- Address: 16625 Redmond way #M-368, Redmond 98052

- Email: Contact@valtarealty.com